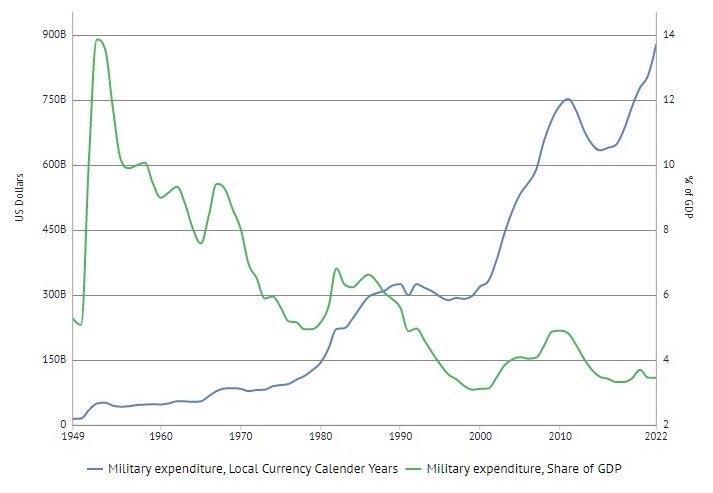

Let’s look at an extremely interesting graph:

Data provided by the SIPRI Military Expenditure Database (http://www.sipri.org/).

In the period from 2015 to 2022, i.e., from the onset of the Russia-Ukraine conflict to its phase of high intensity, a sharp increase in the U.S. military spending (just over 38%) is seen with an actually unchanged share of these expenses in the GDP. This indicates, firstly, that the growth in the production of ‘civilian’ goods and services did not, at least, lag behind the growth in military expenditures, and secondly, that the real incomes of the part of the population (connected with the armed forces and military-industrial complex in one way or another) increased significantly, since the increase in military expenditures did not include cuts in social service programs.

Absolute figures showing an increase in income of the U.S. population associated with defense programs are difficult to calculate, since the largest Pentagon contractors, such as Lockheed Martin, act as prime customers for dozens of companies involved in designing and manufacturing the cutting-edge weaponry, and the information about the financing structure of this cooperation is confidential. In addition, some federal government spending is technically outside the defense budget, although it is an integral part of defense policy decisions; for example, veterans’ benefits and services alone cost $274 bn in 2022 (data from The Peter G. Peterson Foundation). Most likely, it can be said in the first approximation that the rate of growth in personnel costs, including the creation of new jobs and salary increases, is almost equal to the rate of overall growth in spending on defense programs. Anyway, the talk is about hundreds of billions of dollars already received from 2015 to 2022 by the army personnel, officials, corporate managers, scientific and engineering personnel, etc. participating in defense programs. And taking into account the geopolitical realities, there is every reason to believe that the total payments will increase, and at a fast pace.

A similar picture - the exponential growth in military spending while maintaining (and even decreasing) the share of these expenses in the GDP according to the SIPRI data - is observed not only in the USA, but also in China, Japan, Great Britain, Germany, France, Israel, and India, i.e., in most countries that are of importance for the polished diamond market. In the USA and the above countries, skilled personnel working at the enterprises of the military-industrial complex, as well as employees in law enforcement agencies and state employees related to solving the defense tasks can well be classified as middle class in terms of their income and educational qualifications, i.e., they are potential buyers of the most popular categories of diamond jewelry. Thus, the rapid development of defense programs observed in the countries with an appropriate technological base, well-paid scientific, engineering personnel and regular labor force has already resulted in expanding the potential customer groups and, this process will most likely continue and accelerate.

There are many reasons to believe that the future of the Russia-Ukraine conflict that marked the beginning of a new Cold War will be according to the ‘Korean scenario’, and the parties will fix the status quo with the participation of mediators and have many years of negotiations ahead of them against the backdrop of an alternately escalating and subsiding armed confrontation. It is worth mentioning that the peace treaty between the North Korea and the South Korea fixing the result of the 1950 - 1953 war has not yet been signed. In my opinion, the ‘Korean scenario’ is not a forced result of this conflict but its intention and purpose from the very beginning, since it is this outcome that provides a necessary condition for the development of the NATO military-industrial complex that is the true beneficiary of the conflict. The ‘Korean scenario’ will make it possible to maintain and control the image of the threat posed by the newly-appeared ‘Evil Empire’ throughout the entire cycle of creating new-generation weapons (i.e., over 2-3 decades) and justify receiving appropriate funding. So, a side effect of the accelerated funding of defense programs in the NATO countries is the long-term growth in a number of solvent buyers that can be considered as polished diamond market’s potential clients. Obviously, such an audience has a number of specific features that are not used in the existing natural polished diamond marketing.

The today’s media mainstream is armed conflicts and related phenomena in all areas of society, including politics, economics, and culture. This is the main topic of the news in any discourse, it has an effect on millions of people in one way or another, it has become a constant background and a reality, from which there is no escape. It has already penetrated deeply into the diamond market - just remember the unprecedented event at the latest Kimberley Process plenary meeting. And it is absent only in the generic marketing of diamonds where happy people with their ‘eyes wide shut’ still work. For many months now, the natural polished diamond market has been really stagnating as there has been a decline in prices in the mass segments, an increase in inventories, cancellation of sales by the largest rough diamond producers, and outright market cannibalization caused by an introduction of lab-grown diamonds (LGDs). All these negative phenomena are inextricably linked with the all-around failure in generic marketing of diamonds: neither the Natural Diamond Council (NDC) nor the jewelry companies’ marketers were able to offer groundbreaking measures.

Moreover, the natural diamond marketing is completely brought to deadlock today due to a seemingly unresolvable paradox: every third diamond mined on the planet is declared ‘bloody’ and ‘unethical’ in the G7 and the EU countries, and marketers continue their sad murmuring about “consumer trust in diamonds” and that “diamonds do good”. Such dissonance is fraught with a great loss of interest in diamonds. Polished diamonds have [little to] no intrinsic value and it is necessary to constantly convince consumers that they need a polished diamond. If efforts in this direction are insufficient or wrong, the market is low. But the consumer market is changing, as well as the fashion, views, values, the content of information flows and methods of their creation. For polished diamonds to remain ‘forever’, their ‘information shell’ and their image should change, they should be in line with the new target audience’s mentality.

It’s easy to see a possible solution: a new segment of the middle class generated by the new Cold War and having motivational links to military programs and the ‘unethical’, ‘bloody’, ‘military’ polished diamonds also generated by the new Cold War must find each other. To do this, ‘banned’ polished diamonds should have a new image, a new ‘information shell’ built on the most dramatic episodes of the polished diamond market; fortunately, there are more than enough of these episodes. Undoubtedly, the political decision made by the G7 and the EU on the segregation of the Russian rough and polished diamonds will lead to the destruction of regulatory industry institutions, chaotic markets and increased competition. Well, the catchphrase ‘à la guerre comme à la guerre’ acquires a quite distinct diamond shine in such a situation.

Sergey Goryainov for Rough&Polished