Copper market is a favorite topic of industry analysts, and the latest example of BHP’s takeover bid for Anglo American shows that copper assets stand out in mining corporations’ portfolios and are the subject of keen interest from competitors. The closure of a giant mine in Panama in late 2023, as well as lower forecasts for the copper production by major miners and sanctions on Russian-origin metals have created persistent expectations of copper supply disruptions. It is natural that the price of copper, a metal widely used in household appliances, construction, electronics and transport equipment, stands out against the background of other metals not having such clear prospects for consumption growth.

The copper rally before May 20 saw prices rise to a record level of $10.9 thousand per ton, followed by a correction of almost 13 percent by July. Optimism was tempered by the fact that the physical shortage had never materialized due to strong mining output growth in the Democratic Republic of the Congo (DRC) and copper refining in China, and the Chinese real estate industry has yet to recover from the Evergrande Group bankruptcy, which is weighing on demand in this country. Now that the turmoil faded away, market fundamentals have come to the fore. And while weak demand in key consumer sector of China remains a factor of uncertainty, the energy transition and rising electricity demand look like a solid basis for copper to soar high to new peaks in the longer term.

Market balance

The global refined copper market with a volume of 26.5 mn tons was balanced in 2023. According to the forecast of the International Copper Study Group (ICSG), a surplus of 162 thousand tons is expected this year as refined copper production will grow by 2.8 percent year-on-year, recovering from downtimes, accidents and operational problems in 2023 at several projects in a number of major copper-producing countries, including Chile, Japan, India, Indonesia, and the USA. In 2025, the surplus is expected to decrease to 94 thousand tons as the refined copper output will be held back due to the lower availability of concentrates, although it is expected to grow by 2.2 percent year-on-year against the backdrop of the capacity expansion in China, Indonesia and India. Next year, the launch of the Malmyzh project in Russia and the expansion of the Kamoa-Kakula Copper Complex in the DR Congo will be important factors.

Copper mine production in 2023 was 22.4 mn tons, with the largest producers being Chile, Peru and the Democratic Republic of the Congo. Refined copper production (including primary and recycled copper) totaled 26.5 mn tons in 2023, with China being the main supplier of refined copper. In addition to refined copper, about 6 mn tons of scrap copper are consumed annually.

Norilsk Nickel expects a shortage of 0.2 mn tons in the refined copper market in 2024, which is equivalent to three days of copper consumption. In late May, the outlook for shortage was revised up from 0.1 mn tons. The growth in demand will outpace the growth in supply, and copper consumption is expected to increase by 3 percent (to 26.2 mn tons), supply - by 2 percent (to 26 mn tons). The company also expects the shortage to continue in the market in 2025 and estimates it at 0.1 mn tons. “Without developing new deposits, there will be a significant copper shortage in the market in the long term,” Norilsk Nickel notes.

Stumbling blocks to rapid capacity expansion include the risks of land acquisition and connections to grids and networks, as well as water shortages in arid regions, since copper mining typically requires significant water consumption. Back in December 2022, the largest commodity trader and mining company Glencore predicted a copper supply shortage of 50 mn tons by 2030.

Supply concerns

The current year is challenging in the primary copper supply, mainly due to higher levels of mine shutdowns. In late 2023, Canadian producer First Quantum closed its Cobre mine in Panama - that produced about 350,000 tons per year - due to local protests and a tax dispute. Anglo American reduced its copper production guidance for 2024 and 2025 (from 1 mn tons to 710-790 thousand tons and 690-750 thousand tons, respectively), and Vale’s Sossego mine license was revoked. Leading global copper producer Codelco continues recovering from operational difficulties that resulted in declining copper production to 1.32 mn tons in 2023, the lowest level over a period of 25 years.

These factors have led to a shortage of concentrates and a drop in China’s treatment charges to record lows since 1989 and to negative figures, which prompted the Chinese copper smelter association to announce production cuts by 5 to 10 percent, postpone the expansion of existing capacities and the launch of new ones.

In April, the market was affected by the decision taken by the UK and US governments to impose sanctions against the Russian-origin non-ferrous metals on international exchanges such as the LME and CME. Since the bulk of copper stocks at the LME warehouses were of the Russian origin (62 percent in March), this decision was the main reason for the high price volatility in recent months, Norilsk Nickel notes.

A slowdown in China

While the results of the first 5 months show the decrease in the LME copper inventories(by about 30 percent, to 120 thousand tons), the overall level of the exchange inventories is increasing, which is unusual against the backdrop of rising prices. The inventories of the world’s largest metals exchanges are an indicator of market strength for traders and analysts because inventories accumulate when the market is oversupplied and deplete when demand is high. Most of the growth occurred in China (the Shanghai Futures Exchange (SHFE) inventories increased by 870 percent, to 300 thousand tons) and the growth reflects both an oversupply and a weakening physical demand.

China is the largest consumer of refined copper at 14.7 mn tons as of 2022.

According to Bloomberg, copper inventories at the SHFE warehouses in June rose to the highest level since 2020 and amounted to about 330 thousand tons. Zhengxin Futures’ senior analyst Zhang Jiefu said the surplus metal is “simply cannot be consumed” as wire and cable manufacturers are under “enormous pressure” due to a slump in China’s real estate sector. The rise in copper inventories reflects both a slowdown in the sector and generally sluggish manufacturing and lending activity as Beijing shies away from the direct promotion of household consumption.

The real estate sector accounted for more than 20 percent of China’s copper consumption in 2023, according to the study by S&P Global. Property is a key driver of copper demand, and the weakness in the sector is likely to continue as a drag for prices, said Eugene Chan, trading manager at Zhejiang Hailiang Co. There are also some indications that high prices are spurring a greater push for substitution of copper for aluminum.

Wang Wei, general manager of major copper trader Shanghai Wooray Metals Group Co, said that demand was “rebounding a bit,” although only to return to similar levels as a year ago. The weakening momentum in China’s recovery made Goldman Sachs in late May to revise its forecast for average copper prices this year from $9,750 a ton to $8,698 a ton.

Price forecasts

The gap between weak demand in China and the enthusiasm of the funds making bullish bids for copper suggests that China’s industrialization and urbanization are no longer the only drivers in the copper market. The country’s electrification is absorbing ever larger volumes of metal. However, if activity in China doesn’t recover, the sluggish period is not just the result of delayed buying, but an indicator of poor underlying demand. According to the most bearish traders, prices in this case could fall even further - back to $9,000 or even $8,000 a ton.

“The financial market flood of net new length has become a trickle. Without that incremental macro-driven buyer, it comes down to whether the underlying physical market can support the current price,” says Colin Hamilton, managing director of commodities research at BMO Capital Markets.

But with prices having recently fallen, “now the question is whether the more than 10 per cent pullback is enough to change sentiment in China”, said analysts at JPMorgan in a note.

Some analysts say the price of copper could soar in the second half of the year as a result of pent-up demand. “With the decline in price, we’re going to see people take advantage of this,” said Boris Mikanikrezai, analyst at Fastmarkets.

But Daniel Smith, head of the research department at the London-based broker company for AMT metals, believes that prices could fall further this year if the funds that have bought the metal start betting on falling prices.

According to Norilsk Nickel, the situation makes the price rally in the first half of 2024 potentially unstable. Due to the high price volatility in the near future, producers are reluctant to increase output and prefer to acquire existing enterprises rather than invest in the long and highly uncertain process of developing new mines.

Growing demand

As for demand, mixed macroeconomic indicators and ongoing geopolitical tensions are putting pressure on the copper market, but metal consumption is expected to grow by 3 percent annually in 2024, as well as in 2025 and 2026, Norilsk Nickel believes. That said, China and India account for the majority of this consumption growth. Despite slowing economic growth, the demand from China will grow due to increased manufacture of electric vehicles (EVs), the wider use of renewable energy sources, and investments in power grids.

Power grids account for 15 percent of global refined copper consumption, according to the International Energy Agency (IEA). The load on the power grids has been increasing due to extreme weather conditions in recent years.

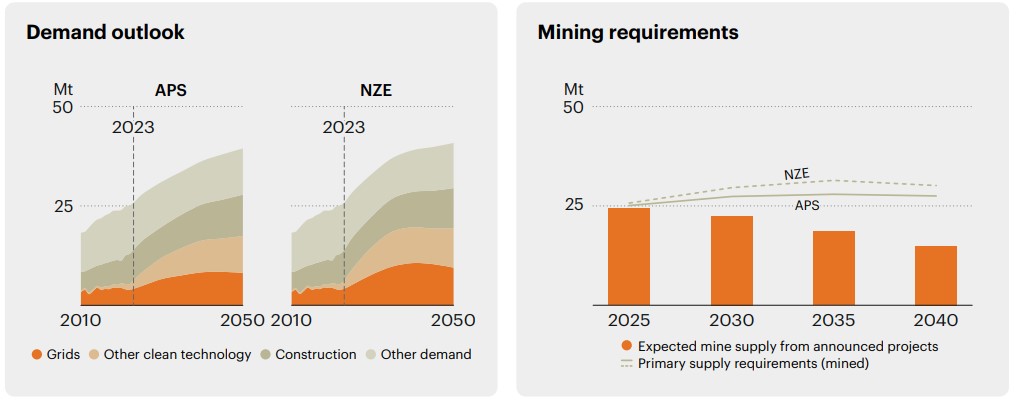

The IEA expects copper demand to grow from 26 mn tons in 2023 to 31 mn tons in the Announced Pledges Scenario (APS) and 33 mn tons in 2030 in the Net Zero Emissions (NZE) Scenario. Electricity networks remain the second largest source of demand in conservative scenarios, but in the NZE Scenario, it becomes the largest source of demand by 2030, outstripping the construction sector. Copper demand from EVs experiences the largest growth in demand, increasing from 2% of demand in 2023 to 12% in 2050.

Source: IEA’s Global Critical Minerals Outlook 2024

While electrification growth slowed in the first half of the year, Norilsk Nickel still sees the transition to ‘green economy’ as the main driver of copper demand. “Unlike nickel and cobalt that are predominantly used in the manufacture of electric vehicles, copper is also used in the construction of charging infrastructure facilities and power distribution networks, which is less susceptible to today’s fluctuations in the EV market,” the company emphasized.

In addition to EVs, copper consumption in renewable energy sources is growing rapidly. The intensive development of these copper-dependent industries has made the correlation between copper demand and macro indicators weaker, Norilsk Nickel notes. Last year, these industries used 3.3 mn tons of copper, up 58 percent year-on-year, mainly driven by solar panel manufacturing. In 2024, copper consumption in these industries is expected to increase to approximately 3.8 mn tons and further to 4.4 mn tons in 2025, which is a 16-percent annual growth.

ICSG estimates the increase in apparent global consumption of refined copper at about 2 percent in 2024 and 2.5 percent in 2025, including a 2-percent increase in 2024 in China and a 1.6-percent increase in the next year. After a 3-percent decline in 2023, the copper consumption outside China is expected to grow this and next years by 2.4 percent and 3.8 percent, respectively, mainly due to the introduction of new capacities for the manufacture of semi-finished products in India and several other countries, ICSG predicts.

Sergey Bondarenko for Rough&Polished