The strategic importance of copper became even more apparent this year when BHP tried to take over the struggling Anglo American and its stakes in copper mines in Chile and Peru as the most attractive assets in the company’s portfolio. And while the recent example of Glencore abandoning the coal business spin-off proves that the days of natural resources enjoying a lower demand from ESG-conscious investors are not over, the importance of copper is proved by its steadily growing role in corporate budgets. With prices rising and production volumes relatively stable, copper is generating an ever-increasing share in revenues, and copper projects underfunded for decades are becoming major components of capex as it is increasingly expensive to maintain the stable supply. As long as this trend continues, there are opportunities for copper megadeals.

BHP

In the spring, BHP, the world’s largest listed miner, tried to take over struggling Anglo American and made a $49 bn bid for the company. The deal would have expanded BHP’s copper business to 10 percent of the global market, increasing its presence in the top copper-producing countries - Chile and Peru - and building up a copper producer larger than Codelco. After the bid was rejected, BHP said it would focus on growing its own copper business and was going to commit to existing and future projects. “It wasn’t Plan A for us,” Mike Henry, chief executive of BHP, said of the acquisition of Anglo.

BHP has been aggressively expanding copper production given the commodity’s huge role in the energy transition and the challenging outlook for its key source of revenues - iron ore - because of a slowdown in China’s economic growth and rise in supplies. In its half-year report, the company gave details of its spending and growth plans in key copper provinces of Chile, South Australia and Argentina.

In Chile, BHP owns 57.5 percent of the world’s largest Escondida mine, which is set to decline its production by the fiscal 2027 due to deteriorating ore grades. To maintain production, BHP considers putting a new concentrator into operation and introduction of innovative leaching technologies that can boost recovery. In South Australia, where BHP purchased copper and gold producer OZ Minerals for $6.4 bn two years ago, the company makes an assessment of options to produce over 500,000 tons of copper a year in the early 2030s and over 600,000 tons by mid-2030s, up from 322,000 tons produced last financial year.

The development of copper assets will account for almost half of BHP’s capex in the 2025 financial year ($4.7 bn out of $10 bn), according to the company’s presentation. BHP is expected to spend $2.5 bn on the iron ore segment.

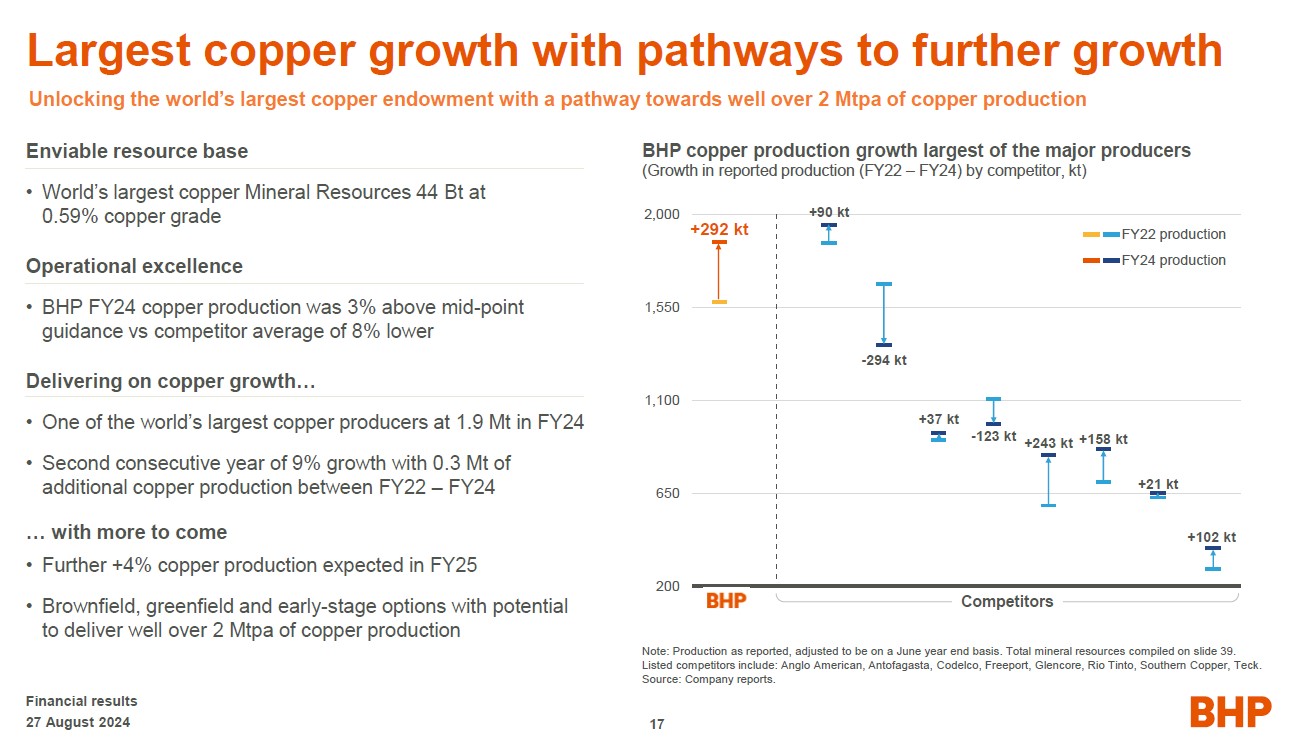

With the world’s largest copper resources amounting to 44 bn tons of ore with a copper grade of 0.59 percent, BHP was ahead of its competitors in terms of production growth for the second year in a row, reaching 9 percent. In the 2025 financial year, copper production is expected to grow by another 4 percent. BHP’s copper business has a 51-percent margin, which is still lower than a 68-percent margin of the iron ore business.

Although BHP is the industry leader in copper production growth, having increased its production by 300,000 tons, the company is still far from making a major leap forward in this area, notes FT’s columnist Camilla Palladino. She cites Barclays estimates that copper output in 2030 will not differ much from today’s 1.9 mn tons, and the production growth will occur only after that date.

Copper currently accounts for less than 30 percent of the miner’s EBITDA (65 percent comes from iron ore), but the company expects this figure to grow. BHP jointly with Lundin Mining Corp. agreed to buy Canada’s Filo Corp. that develops the Filo del Sol copper deposit on the border between Argentina and Chile, for $3 bn. This mine could become one of the top ten copper enterprises in the world.

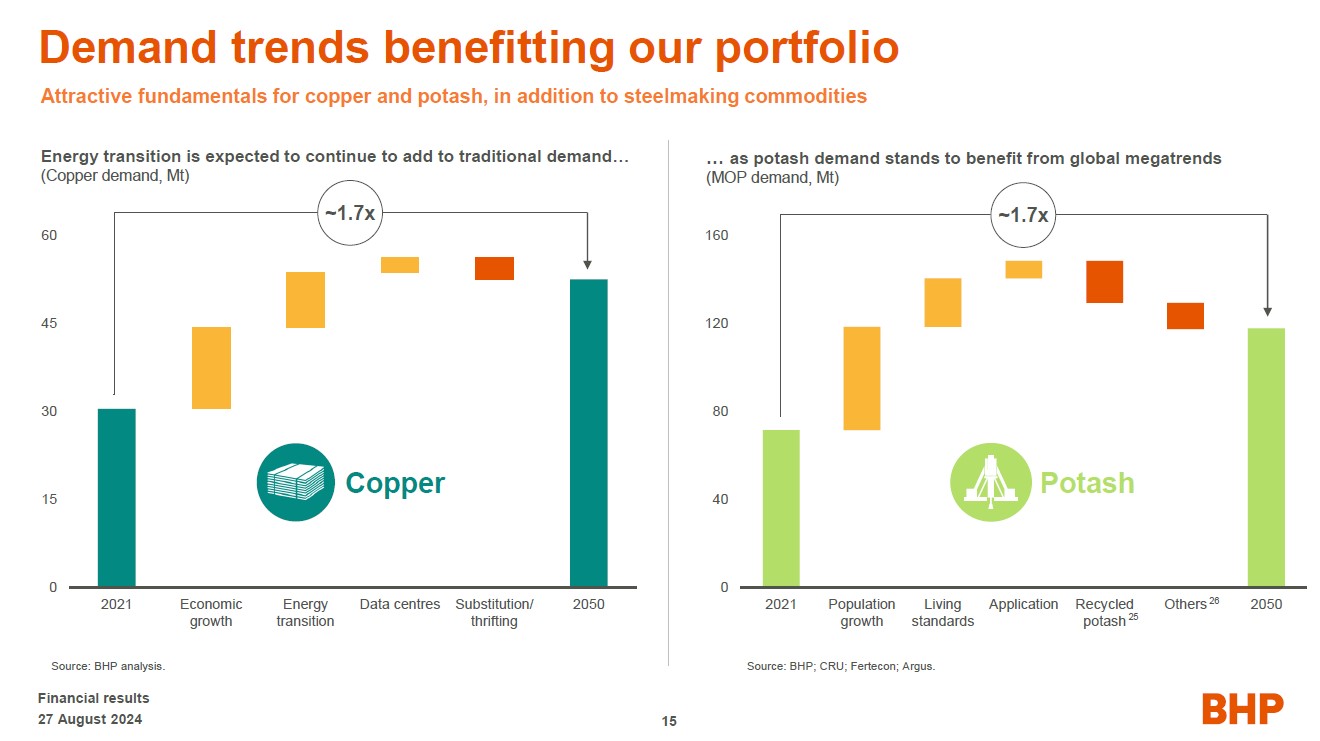

As BHP makes plans to expand into the copper industry, it looks both to the tailwind of the global shift to cleaner energy sources and to the growth of the artificial intelligence market. This is another driver for copper growth that could aggravate the looming shortage of the metal, BHP Group’s Chief Financial Officer Vandita Pant told the Financial Times. “Data centers today account for less than 1% of copper demand, but this is expected to grow to 6-7% by 2050,” said Vandita Pant. According to her estimates, the growing number of data centers, as well as AI developments that require more energy-intensive computing power could further increase global copper demand by 3.4 mn tons per year by 2050.

BHP forecasts that global copper demand is expected to reach 52.5 mn tons per year by 2050, up over 70 percent from 30.4 mn tons in 2021. While BHP acknowledges that the copper market can remain in surplus next year due to sluggish demand in China, the copper market can suffer from shortage by the end of the decade. BHP forecasts that a surge in copper demand ‘in the last third’ of the 2020s can lead to a price spike as demand outstrips supply.

BHP can make another offer to Anglo starting in November. According to BHP’s CEO, the company is not interested in buying Anglo’s coal assets separately. However, BHP is ready to temporarily exceed the net debt target to take up opportunities to increase its portfolio value.

Anglo American

Copper is the main component of Anglo American’s profit, the contribution of this metal to EBITDA in the first half of the year was 41 percent. Another 28 percent were from iron ore, 14 percent from platinum group metals (PGMs), 12 percent from metallurgical coal and 6 percent from De Beers. The profitability of the Anglo’s subsidiary is 53 percent, which is more than twice the margin in PGMs (24 percent), more than four times higher than De Beers’s margin (13 percent) and more than that of the iron ore business (43 percent), according to the company’s presentation.

At the same time, costs in the copper division fell by 15 percent in the half of the year, which is explained by the devaluation of the Chilean peso against the backdrop of increased production at the main copper asset Collahuasi. For comparison, in the PGM sector, costs fell by just 2 percent in the first half of 2024, while they grew by 33 percent in the diamond industry against the backdrop of the construction of the Venetia underground mine in South Africa.

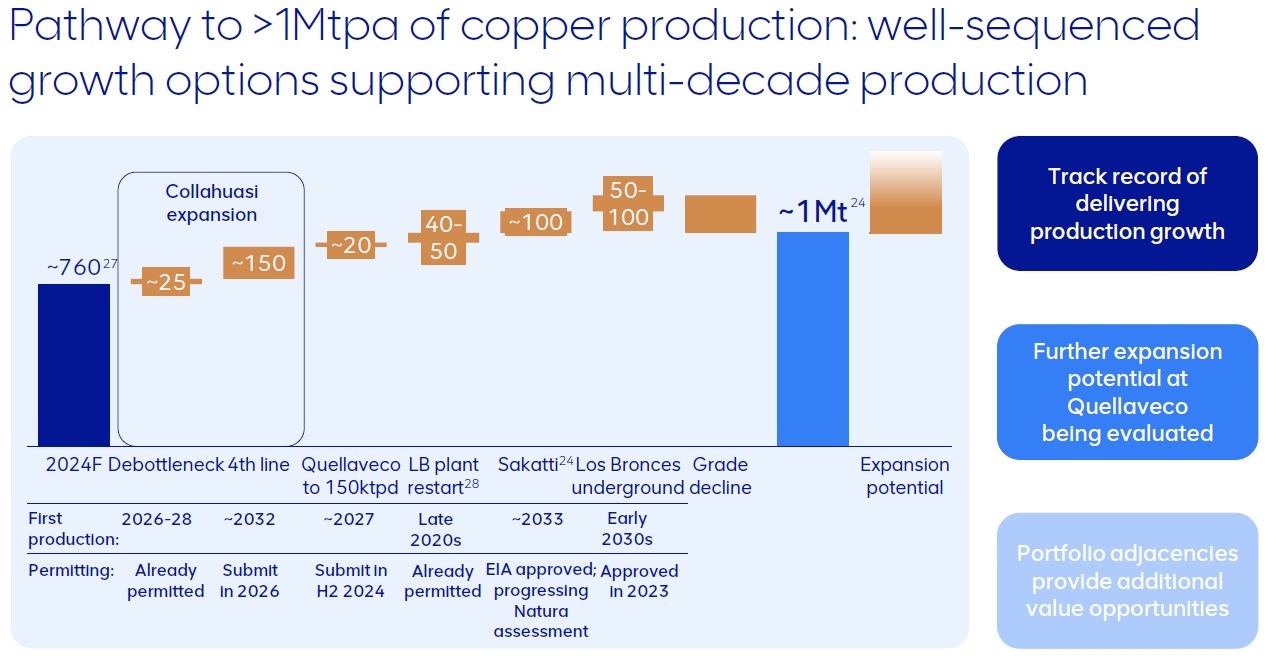

Anglo owns 44 percent of the Chile’s Collahuasi copper mine (another 44-percent share is controlled by Glencore and 12 percent by a Japanese consortium led by Mitsui), which has copper reserves that are among the largest ones in the world. The corporation also controls the Los Bronces copper-molybdenum open pit mine in Chile, large Quellaveco project in Peru, and the Sakatti copper-nickel project in Finland. With the planned expansion of Collahuasi, as well as the putting of Sakatti into operation and switch to underground mining at Los Bronces, Anglo expects to increase its annual copper production from current 760,000 tons to 1 mn tons in the early 2030s.

Anglo’s mature copper assets, still with the potential to grow metal production, are all the more valuable because prospects for developing new deposits are becoming increasingly costly and controversial from a sustainability standpoint. Launching the production at the top 20 currently undeveloped copper deposits that have 176 mn tons of reserves will be complicated by a lack of water resources or the need to negotiate with local communities.

When Anglo American rejected BHP’s bid, it explained that move by undervalued potential of its copper assets. BHP’s final offer implied a long-term copper price at $9,500 per ton, according to Deutsche Bank’s estimations, with the bank’s long-term copper forecast estimating the average price at $9,400 -10,000 per ton. After rejecting the deal with BHP, Anglo presented a strategy for a radical reorientation of the company towards copper and iron ores. The company’s restructuring plan also includes the sale of De Beers and its nickel assets (their contribution to EBITDA is 1 percent only), as well as the split-off of its South African platinum division Amplats.

Anglo classifies another component of its diversified asset portfolio - agricultural fertilizers - as optional. The company was concerned about cutting costs and temporarily slowed the development of the Woodsmith fertilizer project in the United Kingdom, recognizing its impairment of $1.6 bn, which resulted in a corporation’s net loss of $672 mn in the first half of the year (a year earlier, the net profit was $1.26 bn). A slowdown in financing the Woodsmith project is an important part of the efficiency and savings program announced this year. The corporation plans to save $1.7 bn this year and cut capital expenditure by $1.6 bn between 2024 and 2026.

Coking coal assets in Australia have already been up for sale, and Anglo expects to sell them late this year or early next year, although the situation was aggravated by the fire at the Grosvenor mine. The company is also looking for a buyer for its nickel assets in Brazil producing 38 thousand tons of nickel per year. In early September, the corporation announced that its subsidiary had sold 5.3 percent of Anglo’s 79 percent stake in Amplats, raising about $400 mn in accelerated bookbuilding.

Rio Tinto

About 60 percent of Rio’s revenue comes from iron ore, but the company is increasingly focusing on diversifying into metals essential for the energy transition, primarily copper, where it expects a 3-percent growth per year from 2024 when it can produce about 700,000 tons. This growth will be provided mainly by the Oyu Tolgoi mine in Mongolia where work is underway to expand capacity to 500,000 tons from 2028, as well as by a joint venture between Codelco in Chile and First Quantum in Peru.

Rio looks for an opportunity to scale up its copper business and can consider a major acquisition, although the market was currently overheated and Rio was not ready for a deal at current levels, CEO Jacob Stausholm said in late August. Rio’s acquisition list also includes Canada’s Teck Resources that sold its coking coal assets to Glencore and is focusing on copper and zinc.

Teck is another company that intends to focus on metals needed for the energy transition. The company has four copper projects, their development is estimated at about $4.7 bn, and Teck also works to ramp up its production at the second phase of Quebrada Blanca project in Chile, worth about $8.7 bn.

In addition to copper, Rio makes good progress in the development of Rincon lithium project in Argentina, as well as of battery metal mines in Canada and Serbia. The development of the Jadar lithium mine in Serbia under the license granted to Rio by the Serbian government, could cover 90 percent of Europe’s lithium needs and boost the continent’s electric vehicle industry. Rio’s growing copper and lithium production is a “new strategic direction” for investors, according to Macquarie’s analysts.

In the first half of the year, higher production and prices for copper and aluminum offset lower iron ore prices. Iron ore business EBITDA fell by 10 percent in the period, while copper EBITDA rose 67 percent. Iron ore prices fell by about 15 percent in the first half of the year due to the Chinese real estate market crisis.

Rio expects its copper equivalent production to grow about 2 percent this year. Stausholm said the company’s target was to achieve a compound annual growth rate of 3 percent from 2024 to 2028 from its existing projects. The profitability of the copper business is 53 percent, inferior to the profitability of the iron ore business that reaches 67 percent.

Glencore

Another bidder for Anglo was Switzerland’s Glencore, a consolidated mining group and commodities trader. Reuters reported in May - citing sources - that Glencore, Anglo’s partner in Chile’s copper mine Collahuasi, was tentatively studying the possibility of buying Anglo, but no formal offer has yet been made.

In addition to 44 percent in Collahuasi, Glencore owns stakes in the Antamina copper-zinc open pit mine in Latin America and the Antapaccay deposit in Peru. The company also mines copper in the DR Congo where it owns the Katanga and Mutanda copper-cobalt deposits, and in Australia. Glencore’s plans are to produce 950,000 to 1.010 mn tons of copper in 2024, the high level of this prognosis is in line with last year’s figure.

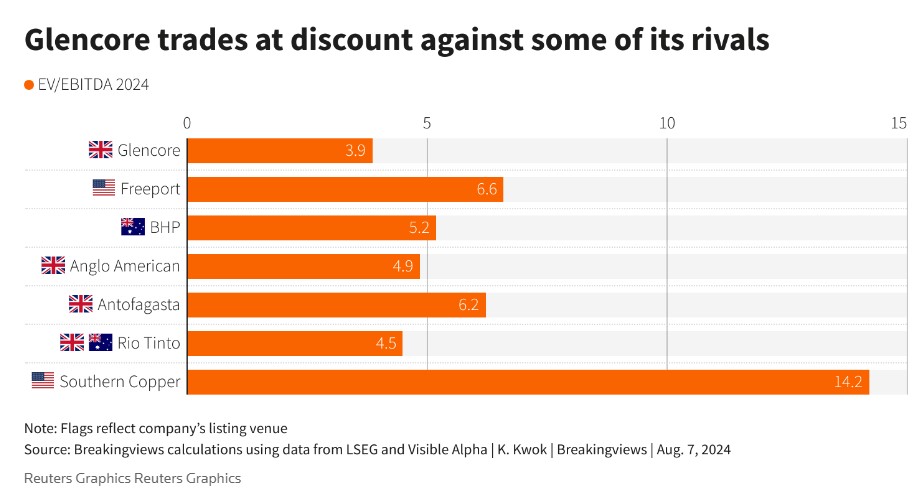

While acquiring Teck Resources’ coal business, following a failed takeover of the whole Canadian miner, Glencore was considering a spin-off of the combined coal assets. This could transform Glencore into a group focused on ‘green’ metals used for the energy transition, primarily copper, increasing its market capitalization. ‘Pure’ copper companies, or producers with a dominant copper stake in their portfolios, such as Antofagasta and Southern Copper, are valued at a premium to Glencore on the London Stock Exchange, as most European investors remain committed to the sustainable development agenda. Glencore trades at a discount against some of its rivals like Rio Tinto, BHP, and Anglo that are more diversified into iron ore (3.9x forecast EBITDA vs. 5x average EBITDA).

However, after surveying its shareholders, Glencore decided not to spin off its coal business. More than 95 percent of Glencore’s investors supported maintaining the business, primarily because fossil fuels would increase the company’s ability to generate cash, which would speed up the distribution of profits to shareholders. Investors’ environmental concerns have moderated over the past nine to 12 months with more of them realizing the role of fossil fuel in energy supplies and decarbonization, Glencore’s CEO Gary Nagle explained. Now, a possible solution to increase Glencore’s capitalization is to move the listing to Australia where the corporation’s main coal assets are located, or to the United States, since the role of climate-focused investors is less in these jurisdictions.

Coking and power-generating coals remain the dominant components of Glencore’s revenues and generate 34 percent of forecast EBITDA in 2024, or $6 bn, which exceeds the contribution of copper at around $4 bn. At the same time, the coal business marginality is inferior to copper business one (30 percent versus 46 percent for the half-year), the company’s presentation says. Investments in copper projects in 2024 to 2026 are expected to account for about half of Glencore’s total capex, which is $5.7 bn annually. The company plans to invest $1.5 bn in the expansion of Antapaccay and $400 mn in new projects Mara and El Pachón in Argentina.

Norilsk Nickel

Russia’s Norilsk Nickel, one of the top 10 copper producers in the world, expects a 3.5-percent decline in copper production in 2024 compared to late 2023, down to 334 to 354 thousand tons in the Norilsk industrial district plus 64 to 68 thousand tons of copper concentrate at the Bystrinsky MMP in the Zabaikalsky Territory. The company explained that the decline in output was primarily explained by a drop in ore production due to a forced transition to new mining equipment.

At current prices, copper can be considered the main component of Norilsk Nickel’s revenues with its share of about 30 percent. For comparison, in late 2021, copper accounted for 21 percent, nickel almost as much (22 percent), and palladium accounted for 39 percent. But the prices for palladium and nickel have weakened significantly, unlike a copper price that grew by 3 percent last year and has increased by another 20 percent this year.

Denis Sharypin, Director of Marketing Department of Norilsk Nickel, said in February that the ores of the Norilsk industrial district were multi-component ones, and the company could increase the extraction of copper products taking into account the market situation. “Within Norilsk, it is possible to prioritize copper ores. This will increase the output [of high-grade copper ore]. There is a certain flexibility,” he said.

Thanks to the ore structure, Norilsk Nickel is well diversified and stable in terms of profitability; EBITDA margin for 2023 was 48 percent, with nickel and palladium prices falling by 30 to 40 percent.

Sergey Bondarenko for Rough&Polished