Following the COVID-19 pandemic, natural diamond prices were up as a result of a rise in the number of people getting married.

Following the COVID-19 pandemic, natural diamond prices were up as a result of a rise in the number of people getting married.

The halt in weddings was a direct outcome of the strict lockdown measures and travel limitations that were in place during the pandemic.

After the bans were lifted, millions of individuals who had postponed their weddings as a result raced to the jewellery stores and the alter to exchange their vows.

In an exclusive interview with Rough & Polished's Mathew Nyaungwa, diamond market analyst Edahn Golan, founder and owner of Edahn Golan Diamond Research and Data, said that the current decline in consumer demand demonstrates a market that is self-correcting following the growth that occurred post-COVID-19.

He observed that De Beers' year-to-date diamond prices were 10% higher when compared to the same period in 2019.

According to Golan, this is evidence that we have returned to the levels we saw in 2019, albeit at higher prices.

What is the current state of the natural diamond supply?

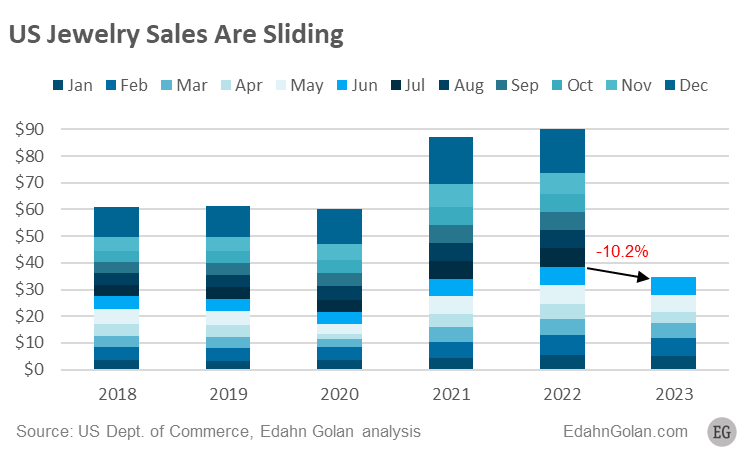

In the year to date, we are seeing a 10% decline in consumer demand in the US and China, the economy is not taking off, leading to a decline in diamond jewellery sales there as well. That has a meaningful impact on the diamond industry, from retail up to mining.

Currently, diamond prices are declining throughout the pipeline, and profitability is eroding. All this has wide implications and requires a deep focus on understanding the changes and responding to them promptly.

What is the level of demand for natural diamonds globally?

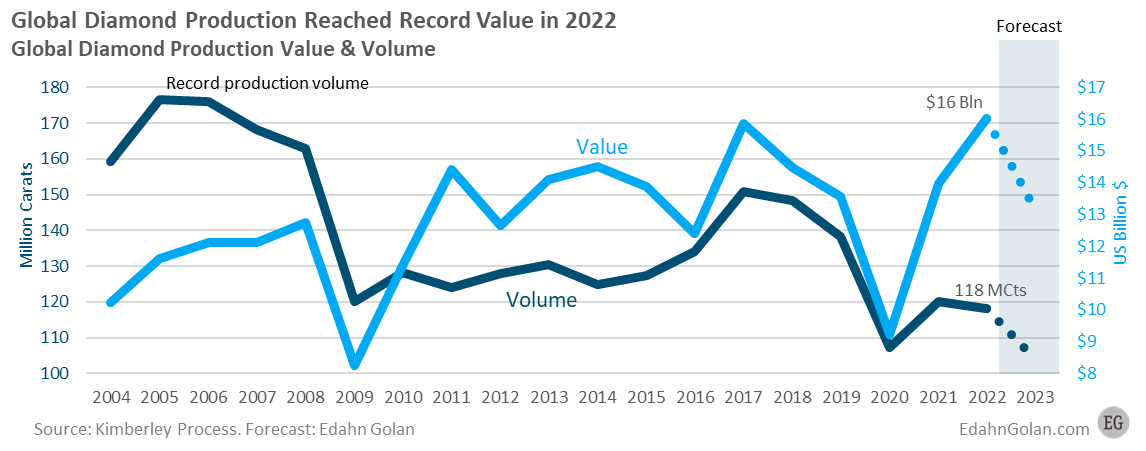

By carats, it was sliced deeply, some 5–10% globally.

What effect does this demand have on production levels?

De Beers is planning to produce 30-33 million carats this year, down from the 35 million carats produced last year, which is a planned decline of about 10%.

Rio Tinto has already cut production by about 10%, and ALROSA is a big mystery. I would estimate that production will fall by about 12% this year, especially if new sanctions come into effect.

What are the future growth drivers of the market?

Primarily population growth. Except for India, the marriage rate is flat or declining in the main diamond consumer markets, and economic concerns are on everybody’s mind.

What are the future sales trends for diamond jewellery?

There is a movement to buy jewellery with larger diamonds, especially when jewellery is set with lab-grown diamonds, but that holds true for those set with natural diamonds. By jewellery category, chain necklaces are the most popular jewellery item and are in growing demand. Tennis bracelets are gaining popularity as well.

According to recent media reports, Angola is holding onto more than one million carats of rough diamonds in anticipation of a price recovery. What is your evaluation of this action?

Very surprising. Rough diamond prices are decreasing after last year’s record highs. Those prices, driven by a surge in weddings post-COVID-19, are gone. There is no reasonable driver for pushing rough prices on the horizon.

In general, sitting on goods during a downturn is not the most proven practise unless there is something unusual about the goods or cash flow is of less importance.

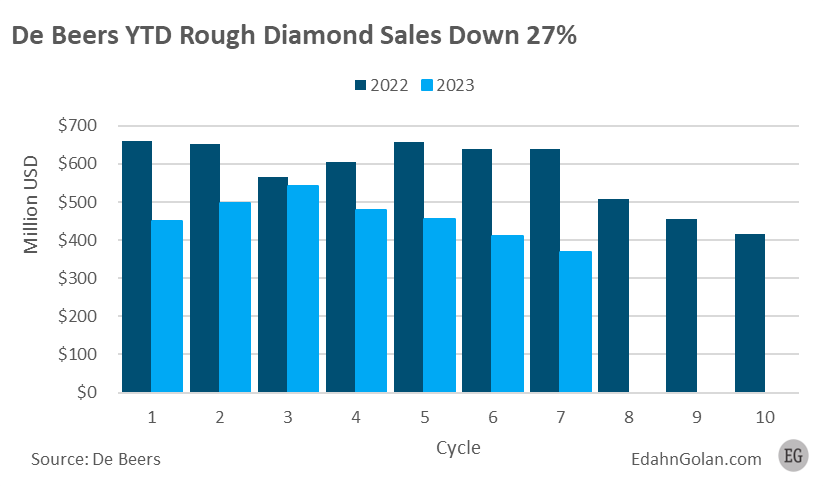

The seventh cycle of De Beers saw a 42% decline in rough diamond sales to $370 million. Year to date, you saw that the company's rough diamond sales had decreased by 27 percent compared to the same period the previous year. What elements are contributing to the decline in sales?

Everything we have discussed so far can also be characterised as a return to pre-COVID-19 trends. Add to that a certain rise in inventory and disciplined management by Sightholders.

De Beers, wisely, in my opinion, adopted a flexible model with the market on rough diamond supply. It is healthier for all.

You also saw that De Beers' rough sales are 10% higher year-to-date compared to the same time frame in 2019. What does this comparison tell us?

That the industry is ahead of the game. We are back to 2019 levels, but with higher prices.

What are the factors that contributed to the boardroom coup that saw Eira Thomas removed as CEO at Lucara?

The company spoke of concerns over share price value and the rising costs of going underground. I’m not sure much will change with the share value during a downturn in the diamond market.

How optimistic are you that William Lamb's 'Parousia' moment will enable the company to attract institutional investors?

At this point, to stand out, you need to show that you can weather the situation, be innovative in ensuring they get every large stone they possibly can out of Karowe, and prove that the company is solid in every way. If they succeed in doing that, they may find investors.

Mathew Nyaungwa, Editor in Chief of the African Bureau, Rough&Polished