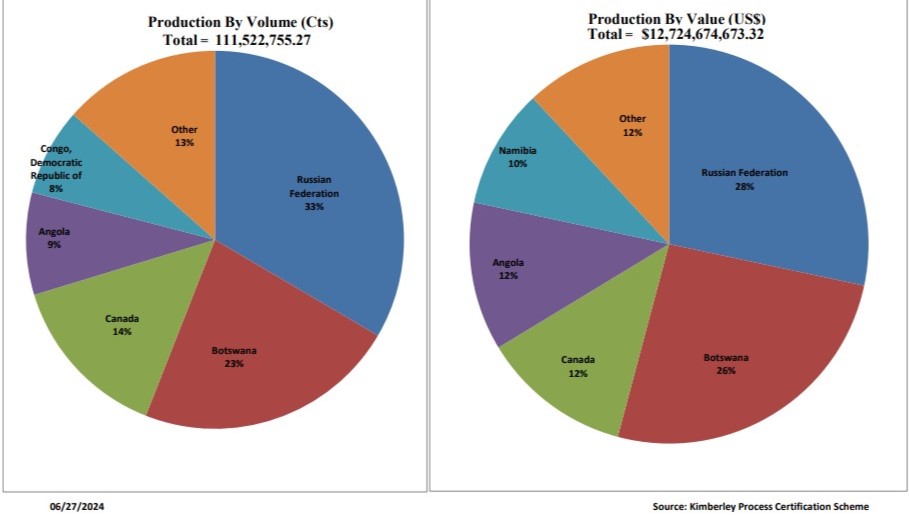

The Kimberley Process (KP) recently released its 2023 statistical data for trade and production of rough diamonds, by value and volume.

What is of interest from the dataset is that the value of Russia's rough diamond output exceeded Botswana's for the first-time last year despite sanctions by the European Union and the G7 coupled with a poor market, which hampered the East European country's gem sales.

Russia produced 37.3 million carats of rough diamonds in 2023, valued at $3.61 billion.

The country produced 41.9 million carats a year earlier, worth $3.55 billion.

On the other hand, Botswana recorded an output of 25.1 million carats in 2023, valued at $3.28 billion.

The southern African country produced 24.5 million carats in 2022, worth $4.7 billion.

Lower production at the Jwaneng mine, owned by Debswana, a joint venture between De Beers and the government of Botswana, was a contributing factor in Botswana's decline in output last year.

Debswana is also expected to cut its production this year due to lower demand for rough in the global market, according to the company's senior corporate relations manager, Matshidiso Kamona, in an interview with Reuters in January.

Should the Russians maintain or increase their 2023 output levels, then chances are high that they will hold the pole position in 2024, given Botswana's projected decline in output.

Stronger

However, Botswana's average price per carat remains stronger compared to that of Russia, and this means one thing: it won't take long for the African country to reclaim its spot once it boosts production.

Botswana's diamonds were sold at an average price of $131 per carat in 2023, compared to Russia's average price of $97 per carat.

In 2022, Botswana registered an average price of $192 per carat, while Russia sold its rough at an average price of $85 per carat.

Given this price gap, there is no doubt that the quality of diamonds produced in Botswana is superior compared to that of Russia.

It also remains to be seen whether the sanctions levelled against Russian diamonds will cause a serious dent in their sales.

For now, the sanctions appear to have done little harm, if any.

Interestingly, Namibia, which produced diamonds valued at $1.23 billion in 2023, remained the producer of the best-quality rough in the world as its stones recorded an average price of $517 per carat last year.

The bulk of the southern African country's diamonds come from the bottom of the Atlantic Ocean.

Debmarine Namibia, a joint venture between De Beers and the Namibian government, was responsible for almost 80% of the country's overall rough output last year.

Debmarine had been investing in new vessels to extract more diamonds off the coast of Namibia.

It launched a $420 million custom-built Benguela Gem vessel in March 2022 to boost its output of high-quality diamonds by 500,000 carats per year.

Among other top diamond producers by volume in 2023 was Canada, sitting in third place, having produced diamonds worth $1.54 billion at an average price of about $97 per carat.

Angola was behind by just a fraction, as its output was roughly valued at $1.53 billion with an average price of $157 per carat.

Mathew Nyaungwa, Editor in Chief of the African Bureau, Rough&Polished