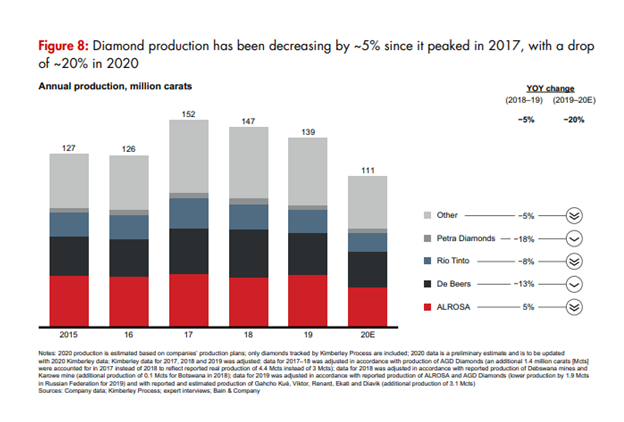

After peaking at 152 million carats in 2017, rough diamond production has declined by about 5% per year.

Bain & Company, which prepared the report said the biggest decreases in 2020 came from Russia, Canada, Botswana and Australia.

In Russia, production levels were lowered at Botuobinskaya, Jubilee and other smaller mines, while production in Canada declined due to suspended mining operations at Ekati and Renard last March.

In Botswana, Jwaneng and Orapa decreased production by 26%, while in Australia, Rio Tinto closed the Argyle mine last November 2020.

Source: Bain & Company

The only mines that increased production were Venetia in South Africa, the Udachny underground mine and Nyurba Alluvial deposits in Russia.

“Production is expected to remain stable in 2021, driven by the reopening of profitable mines that were suspended in 2020, however, the increase will be offset by [the] closure of Argyle,” said Bain.

“During the next 3–5 years, production will likely grow by 0% to 2% [per annum] to allow the value chain to fully rebalance.”

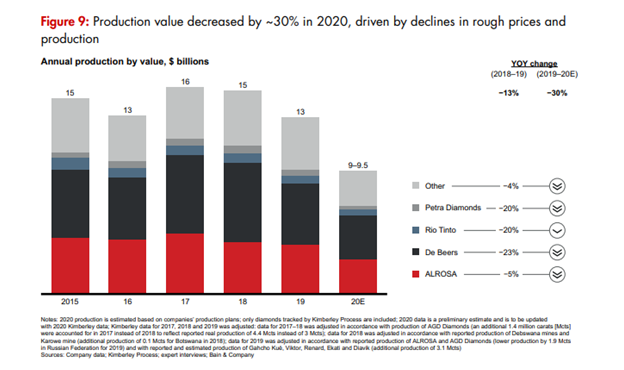

Meanwhile, the report stated that production value decreased by about 30% in 2020, driven by declines in rough prices and production.

Source: Bain & Company

Annual rough diamond sales continued on a downward spiral last year as they dropped 33% due to the impact of the COVID-19 pandemic.

The report noted that reduced sales activity in the first half of 2020 exerted pressure on profitability, which is expected to improve by year-end.

Sales of polished diamonds fell by 25%, and net imports of rough diamonds to key cutting and polishing countries dropped by 26% year over year in 2020.

Bain said the COVID-19 pandemic simultaneously disrupted the supply and demand sides of the diamond market.

“Logistical collapses, lockdowns and business closures rocked supply chains. On the demand side, loss of income from morbidity, quarantine and unemployment weakened economic prospects and lowered household consumption,” reads the report.

“Consumer interest in the diamond category remained strong, but consumer behaviour and preferences changed.”

Despite disruptions, the midstream finished the year in good shape, it said.

Demand for polished diamonds rose in the second half of 2020, leading to a polished price recovery and only a 3% decrease year over year.

“Inventory levels decreased by 22%, which is healthy for the segment,” reads the report.

“Profitability moved from near breakeven in prior years to 3% to 5% margins. Cutters and polishers of high-quality diamonds benefited the most; demand for such diamonds was strong in the second half of 2020.”

It projected that diamond jewellery demand will recover to pre-pandemic levels between 2022 and 2024, with China leading the way.

Mathew Nyaungwa, Editor in Chief of the African Bureau, Rough&Polished