In Q4, revenue doubled q-o-q to RUB 98.6 bn (up 53% y-o-y) on the back of strong demand recovery toward year-end. For 12M, revenue came in at RUB 221.5 bn (down 7%).

EBITDA1 in Q4 grew to RUB 31.8 bn (up 24% q-o-q) thanks to higher diamond sales on the back of recovering demand from both the cutting and polishing industry and end consumers. 12M EBITDA stood at RUB 87.6 bn (down 18%).

EBITDA margin in Q4 amounted to 32% (Q4’19: 46%) on higher sales of small diamonds. For 12M, the margin was 40% (45% in 2019).

Net profit in Q4 increased to RUB 21.3 bn (up 2.8x q-o-q), driven by top line growth. For 12M, net profit stood at RUB 32.2 bn (down 49%) amid lower revenue coupled with the negative impact of the FX rate in the wake of rouble depreciation.

Free cash flow (FCF) in Q4 grew 2.9x to RUB 65.2 bn as a result of operating cash flow going up to RUB 69.6 bn. In H2’20, FCF was at RUB 87.8 bn, and in 12M it expanded to RUB 79.5 bn (up RUB 31.9 bn).

In Q4, capex decreased to RUB 4.4 bn (down 18% q-o-q and 36% y-o-y). 12M Capex totalled RUB 17 bn.

2021 outlook: production – 31.5 m cts; capex – ca. RUB 25 bn (vs the previous guidance of RUB 29 bn).

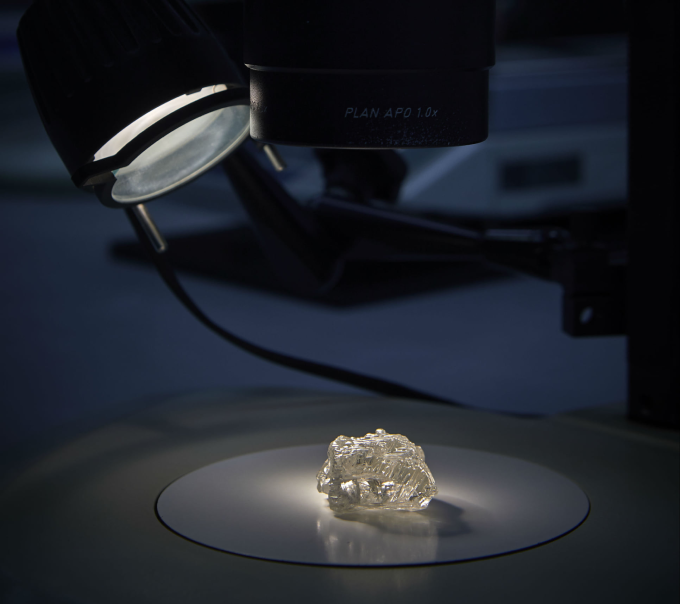

Alex Shishlo для Rough&Polished